The key to taking care of your debt is listening to the small print. See what your overall regular monthly individual loan payment may be by checking your price.

Getting a $two,seven-hundred loan commences with using inventory of your respective financial situation. Checking your credit history can give you a sense of the sort of conditions you would possibly get over a loan, as well as assistance set expectations to the browsing procedure.

Car title lenders: You may get a 15 to 30-day loan equal to your portion of your automobile's worth. The curiosity is very high-priced (as much as 25% of Anything you borrow), and also you chance getting rid of your car if you can't spend again such a loan. Stay away from them if at all possible.

Alliant Credit score Union may be a sound preference in the event you’d like a private loan with versatile repayment terms along with the probable to get a identical-working day loan.

A copyright Bank own loan could possibly be worthwhile if you need a personal loan and have superior credit score or can implement by using a co-applicant with a stable credit score record. Nonetheless it’s not readily available in every single point out, so you’ll have to borrow a bigger sum of cash to lock in the lowest rate.

To determine the Personal debt Savvy Index, we weighted all 4 factors Similarly. We ranked the towns on Each individual in the groups and then indexed each class.

Character—may possibly incorporate credit score background and experiences to showcase the track record of a borrower's skill to meet financial debt obligations before, their do the job encounter and income amount, and any outstanding legal criteria

Revenue: To qualify, you’ll really need to present a lender that you've more than enough steady revenue to help make your potential month to month loan payments. You typically do that by attaching financial files to the loan software, like W-2s and lender statements.

After you borrow income from a lender, whether it’s a personal Good friend or possibly a lender, you’ll require to find out the overall price of spending again the loan.

Any time you refinance debt, you exchange your existing debt by using a new loan that includes a lower APR, conserving you cash. The increased the main difference in APR among your current credit card debt and the new loan, the larger the savings.

A private loan calculator demonstrates your month-to-month particular loan payments based upon the loan total, curiosity rate and repayment expression. In addition, it exhibits the entire desire Value, with or with out an origination rate.

Cost of loan: The whole desire you’ll pay as well as the origination fee, which represents the entire Charge to borrow. This number doesn’t Show should you enter a set origination rate quantity.

Nevertheless, this does not influence our evaluations. Our thoughts are our possess. Here's an index of our associates and here's how we more info make money.

Make your Verify payable to Citizens then mail it to your handle in your billing statement coupon or if you don't have your assertion coupon, mail your payment to:

Jaleel White Then & Now!

Jaleel White Then & Now! Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Barbi Benton Then & Now!

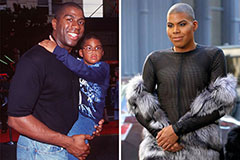

Barbi Benton Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!